Our publications

Overview of the Russian market of surgical satures

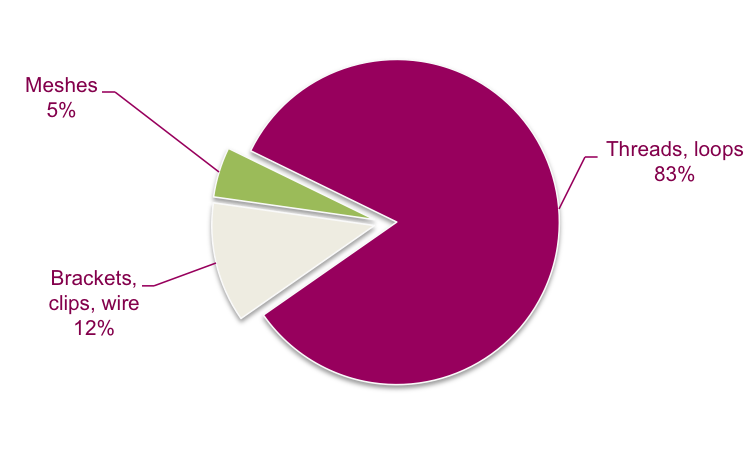

Russian market of surgical satures. The Russian market is worth about RUB 4.8-5.0 bln a year. Various threads account for 80% of it.

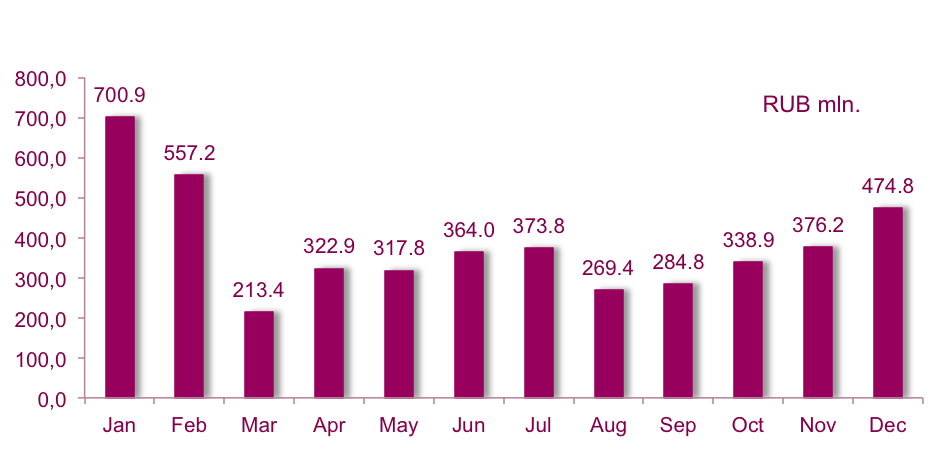

Higher figures in January-February of 2014 had to do with a large number of tenders announced late in 2013 – a last-moment attempt to take advantage of the expiring law 94-FZ. Winners for these tenders were determined and contracts signed in 2014, so actual normal value of public procurement is RUB 300-350 mln per month. Most sutures are consumed by public health facilities because it is they who perform the majority of surgeries. We estimate the private sector’s share at no more than 10%.

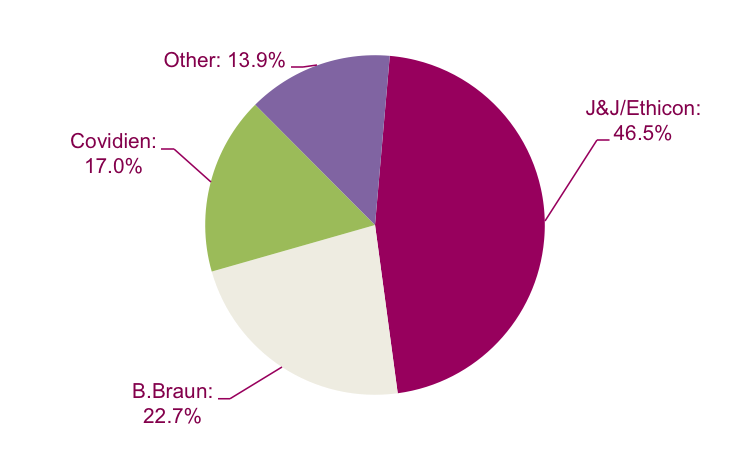

In terms of competition the map of the Russian market is similar to that of the global, with the international leaders dominant here as well. The companies mentioned above produce 85-90% of sutures consumed in Russia. Their sales are measured in hundreds of millions of rubles per year.

Their nearest competitors’ sales are several times smaller, in the millions or tens of millions.

On this market domestic producers have some 8-9%. The remaining 4-5% is shared between marginal foreign manufacturers. Products of the Italian Ergon Sutramed are often advertised online; the German Resorba has a website in Russian. Threads India Private Limited, a significant international manufacturer estimated is practically unknown in Russia. But althought companies’ sales are often low, their list is long. In the descending order of notability:

Foreign suture makers:

ü

Johnson & Johnson, USA

ü

Covidien, USA

ü

B. Braun, Germany

ü

Resorba, Germany

ü

CATGUT, Germany

ü

SMI АG, Belgium

ü

Ergon Sutramed, Italy

ü

MANI Inc., Japan

ü

Helm Medical GmbH, Germany

ü

Stericat, India

ü

Sutures India PLC, India

ü

and others…

Russian suture makers:

ü

MZKRS Shovniye Materialy

ü

Lintex

ü

MedEng

ü

Polytechmed (part of Sterion Group)

ü

Medin-N

ü

Volot

ü

Krsnogvardeyets

ü

Mosnitki

ü

Tatkhimfarmpreparaty

ü

Balumed

ü

and others…

All companies, foreign and domestic, have a similar range of offerings – with natural and synthetic thread, absorbable and non-absorbable.

The largest manufacturers of surgical satures

Foreign manufacturers

Ethicon (part of Johnson & Johnson), is the global leader in the sutures sector. It is a subsidiary of Johnson & Johnson with headquarters in New Jersey, USA. The company manufactures a broad range of surgical devices: threads, needles, glue, draining implements and hernia meshes. It has factories all over the world – in France, India, Switzerland, Germany, Brazil, China, UK and USA.

Its share of the global market is about 58%, of the Russian somewhat smaller – 47%, but it is an unquestioned leader here as well. Ethicon offers a great variety of absorbable and non-absorbable threads, needles of various sizes and shapes.

Covidien specializes in medical expendables for surgery and prolonged treatments, as well as packaging and sterilization devices. It is based in Sublin, Ireland. Covidien’s turnaround for all products is estimated at USD 10 bln.

It is the world’s second-largest manufacturer of sutures with 15% of the market, Russia’s third-largest 17%. It offers numerous Absorbable and Non-absorbable threads, needles of all shapes and sizes.

Aesculap (part of B. Braun) is a German manufacturer of medical devices. It makes devices for controlled drug treatment, surgical instruments (Aesculap), artificial kidney devices, devices for chronic patient treatments and surgery expendables, including needles and sutures. Its headquarters is located in Melsungen and its turnaround per year is estimated at USD 6.9 bln.

Though third globally (6.5% of the market), it is second in Russia with 23%. A wide selection of absorbable and non-absorbable threads and needles are offered.

Russian manufacturers

There are more than 15 Russian companies selling branded sutures. Most of them buy starting materials (synthetic thread and needles), cut them, attach the needle, package and sterilize the kit. Because of this quality is completely on par with imports.

CJSC MedEng is a maker of advaned expendables for cardiovascular surgery. A leader on the artificial valve market, in the last few years it has diversified into stenting and sutures. Considering that sutures are a sideline, MedEng’s selection is adequate, including an absorbable polyglycolide thread and several non-absorbable types: lavsan, kapron, polypropylene. MegEng’s volume of business for these products is comparable to sales of Russian companies specializing in sutures.

MedEng’s share of the Russian market is 2.5-3%

LLC Lintex is located in St. Petersburg. Its products include sutures, mesh endoprosthetics, adhesion barriers, wound dressings and urogynaecology instruments. Its product range is somewhat more limited than that of international leaders, but all most popular mono- and polyfilaments are available, coated and not.

The company’s market share does not exceed 2.0-2.5%.

LLC Medin-N is a Yekaterinburg manufacturer of surgery needles and threads. Surgery expendables are its specialty. It makes puncture needles, infusion sets, packaging, surgical needles and a modest assortment of absorbable and non-absorbable threads.

It has about 1 % of the market.

LLC Polytechmed is part of Sterion Group. It is unique in that it only assembles kits from purchased needles and threads, sterilizes and packages them. It is based in Moscow.

The company’s share of the market is negligible.

The largest suppliers of surgical satures

Dzhi El En-Invest, Paritet group and Delrus group are Russian suppliers of satures which had the highest delivery volumes in 2014.

Table 1 – Top-10 suppliers of satures on the Russian market

|

Supplier |

Delivery volume in 2014 (US dollar) |

|

Dzhi El En-Invest |

6 632 717 |

|

Paritet group |

3 439 349 |

|

Delrus group |

3 133 466 |

| Uralmedsnab | 2 800 335 |

| Medicinskaya kompaniya "ArhiMed" | 1 796 819 |

| Taman | 1 793 258 |

| Eff | 1 695 308 |

| Amadeus | 1 581 923 |

| Farminter | 1 449 519 |

| Piligrim-M | 1 434 437 |

MDpro's Data Collection Methodology

How do we calculate figures for Russian medical device market?

All researchers know that the method of data collection is one of the key factors determining data quality.

Our research experience proves that conducting expert interviews is not the best way of getting medical device market figures. Analysis of data, reflecting real market processes (public procurement, export-import operations) is more helpful for achieving this goal. Using this type of data you rely on real statistics, not somebody’s assumptions. It is a strategy used by MDpro for data collection.

Two main sources of information that we use to gather information about Russian med-tech market are the following:ü The public procurement of medical devices database – the database on public (government and municipal) procurement of medical devices and expendables for medical facilities;

ü The exports and imports database – the database of customs transactions for medical devices and expendables.

How do we deal with public procurement data? Data on public procurement of medical devices is the most valuable source of information about Russian med-tech market because public procurement accounts for a large proportion of demand in the market. In the 1st half of 2014 75% of all medical devices in Russia were purchased under government contracts.

Russian public procurement rules govern the way in which public bodies purchase goods. All procurements made by every public healthcare centre are made in accordance with the procurement standards. The data on public procurement and tenders is published on the Internet. The federal site www.zakupki.gov.ru www.zakupki.gov.ru/epz/contract contains information on every procurement deal made by all Russian public institutions.

This website contains a list of all procurements made by all Russian public institutions (it is listed according to a contract date). Since information on the website is not classified, it is impossible to select only data regarding medical devices procurements. You have a list of all kinds of contracts.

Contract information includes data on a buyer, a seller, a name of purchased item, number of purchased items and their price, the total contract value. Follow this link to see the example of contract’s description published on the website: www.zakupki.gov.ru/epz/contract

Dealing with public procurement data includes a few steps. Firstly, data are collected and processed automatically with the help of specially developed computer algorithms. It allows us to ensure data integrity, which is not available while implementing manual data collection. Secondly, gathered data are checked and broken down by segment of medical device market. What we finally have is a complete list of all contracts for the whole medical device market and its 300 segment/subsegments under analysis.

We do not use any sampling-based method – information about each public procurement contract is collected and analyzed. It guarantees that our figures are accurate and precise.

To calculate the size of public procurement market (incl. segment breakdown) we add all relevant total contact values together.

To get figures for the whole market and its segments (public + private consumption), we also use data about local manufacturing and customs statistics (export-import operations). These data are particularly necessary for the analysis of the segments dominated by private consumption.

It is worth noting, that a list of all contracts (with full description of them) is a perfect source of information that allows us to get information about Russian medical device market in different breakdowns. For example, we can analyze separate segments of the market or reveal characteristics of medical devices consumption in different regions.

Even though public procurement data and import-export trade statistics are must-have data for us, they are not the only information source that we use. We also refer to official health care statistics, publications of international marketing agencies, companies’ official reports and industry news. Such knowledge is required for understanding market trends and being ableto look behind the figures.

If you need more information about Russian medical device market, please contact us at info@md-pro.ru

Russian Medical Device Market Outlook 2014-2018

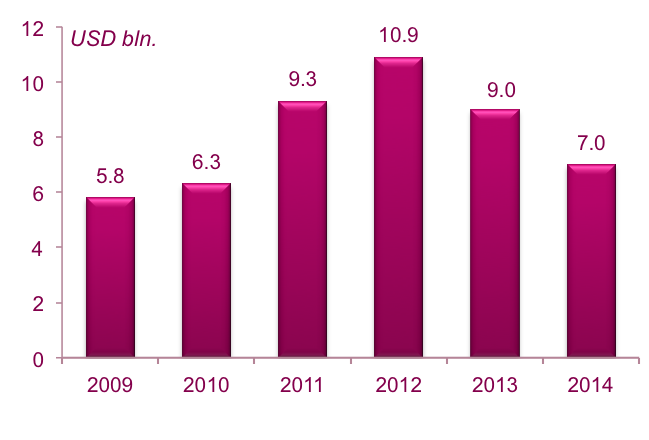

The Russian medical device market demonstrated rapid growth over the period 2006-2012. Consumption increased with state support of health care, in particular under the 2011-2012 regional modernization programs worth RUB 635.7 bln., a large portion of it spent on equipment upgrades. With the programs played out, public health centers could not support the former level of demand.

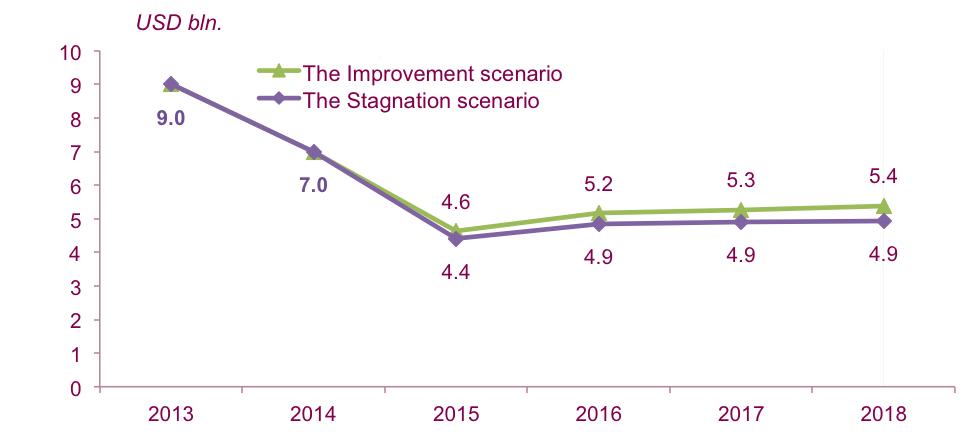

Growth of the market in 2011-2012 gave way to a downward trend in 2013 when the market shrank by 16% from 2012 (in rubles). In 2014 the slide continued, with customers spending 6% less on medical devices overall; taken separately, public buyers spent nearly 10% less. Dollar worth of the market suffered further because of the ruble exchange rate’s collapse in 2014. Thus, in 2013 the market was worth USD 9.0 bln, in 2014 7.0 bln – down by 22%.

The 2013 decrease was a consequence of the market’s oversaturation in 2011-2012 when regional health care modernization programs were in effect. In 2014 the reasons were different: public funding for health care was cut and some of the money diverted from outfitting to pharmaceuticals and wages. That year a sweeping health care reform was also started, which may eventually bring down the public share of device consumption.

In 2013 spending was often redirected from serious acquisitions to maintenance of equipment pools and expendables. This tendency became less pronounced in 2014 as the market stabilized and segments returned to more natural proportions.

Public procurement of medical devices. The Russian healthcare system is a government-run system. It means that the majority of healthcare institutions are owned and financed by the government. The result of it is that in 2014 72% of all medical devices were purchased under government contracts.

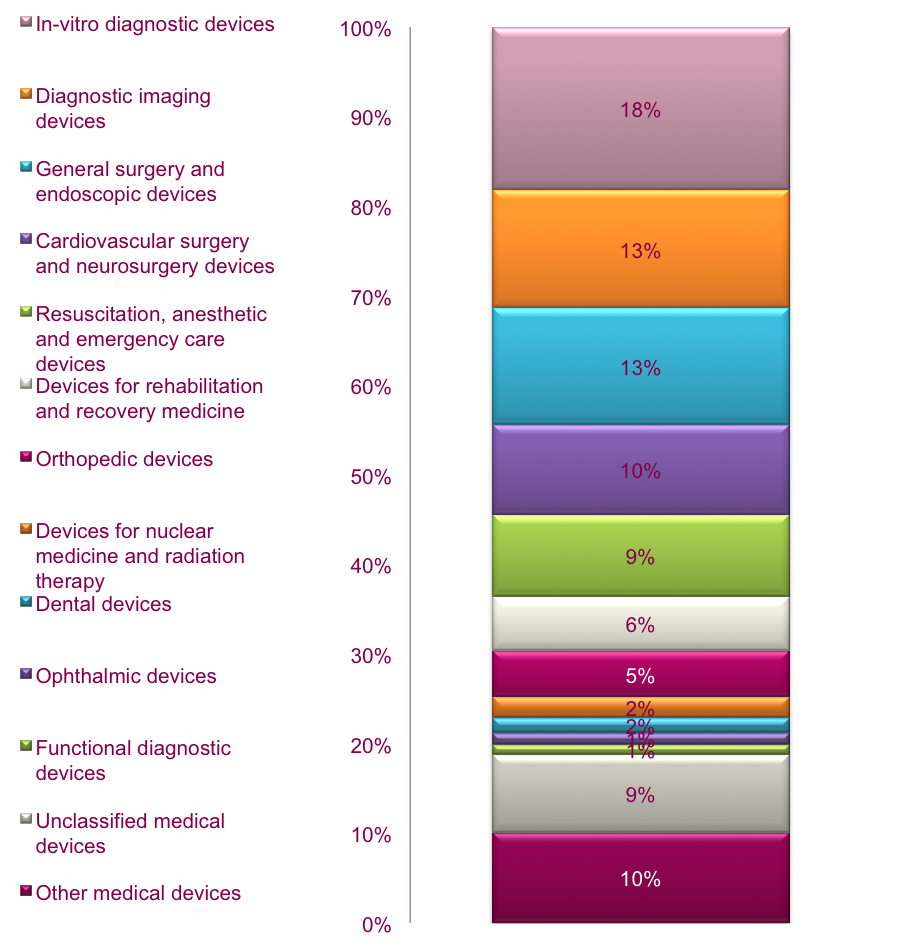

The largest sergments for 2014 were In-vitro diagnostics, Diagnostic imaging and General surgery and endoscopy, together making up 45% of all public contracts.

Imports of medical devices to Russia. Russian medical devices cannot compete with foreign advanced equipment, so the market depends on imports. In 2014 imports’ share was almost the same as in previous years – around 85%. In 2014 combined value of imports was RUB 2.1 bln less than in 2013 – a 1% fall.

The bulk of imports are in the segments of Diagnostic imaging devices (18%), In vitro diagnostic devices (14%) and General surgery and endoscopic devices (11%).

60% of all imports in 2014 came from Germany, USA, China and Japan. Germany’s share is currently 25.2%, for five years running it has remained Russia’s main source of medical devices, even though the global leader is the United States.

The largest importers of medical devices to Russia in 2014 were such companies as GE Healthcare, Johnson & Johnson, Siemens, Storz Medical and Roche.

Exports of medical devices from Russia. Pure exports in 2014 amounted to RUB 3.4 bln – 13% more than in 2013. Reexports, just like in 2013 made up 30% of the exports total.

Most exports in 2014 were in the following segments:

ü

In-vitro diagnostics (RUB 940 mln, 28% of total) – from reagents and test systems;

ü

General surgery (RUB 449 mln, 13.3%) – from bandages (wool, gauze, band-aids etc.);

ü

Nuclear medicine (RUB 413.6 mln, 12.2%) – from accessories and expendables.

Among Other devices steam sterilization units and indicators are sold (brought RUB 68 mln in 2014). Equipment for paramedical helicopters sold for RUB 25.7 mln, special furniture for RUB 25 mln.

Russian medical device market forecast until 2018. The general trend in global and Russian health care reflects a gradual aging of the population. As the standards of living improve with medical advancements, the number of elderly patients requiring medical care rises.

In addition, Russia unlike North America and Europe is actively developing a system of health insurance, which constantly works in favor of demand.

In the long run Russia’s need for medical services will increase, hence the 5-10% yearly growth.

The Russian market’s quick growth in 2012 had to do with procurement under modernization programs and new official outfitting standards for health care centers. In 2011-2013 the federal budget had spent a total of RUB 635.7 bln. on these programs.

As already noted in 2013’s consumption fall is a consequence of the 2011-2012 oversaturation. Devices bought in 2011-2012 would have been acquired normally in 2012 -2015.

This situation has led to a redistribution of public budgets in 2013-2016 towards maintenance (repair, expendables) at the expense of new devices.

Special factors can help restore demand somewhat:

ü

The federal government’s order 2302 of 09/12/2013 requires construction and commissioning of 32 perinatal centers. Most of these projects will start late in 2016 – early in 2017.

ü

Also in 2015-2017 measures to develop nuclear medicine should come into effect, creating some small demand for new devices.

Key obstacles to growth of the market of medical devices in 2015-2017

Decreased demand from public buyers. The health care system is reducing consumption of medical devices, including those made in Russia. Budget-allocated funding in 2015-2016 may be cut by 10-20% from the 2014 level, while the health care system continues to be 80-85%-dependent on imported products.

Volume of orders in 2015 will almost certainly shrink (value is not expected to suffer so strongly). Public buyers consume mostly foreign products whose prices grew by 30-40% as the ruble fell.

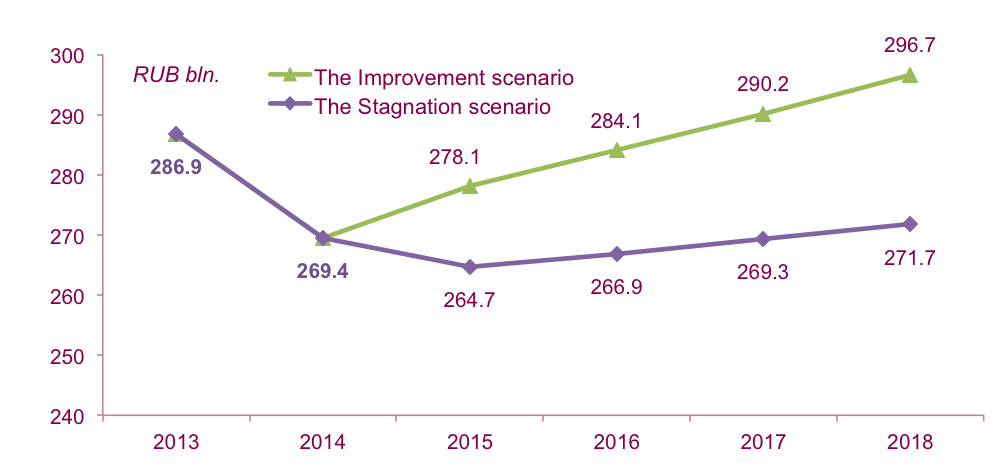

Together these factors allow us to formulate two scenarios for the market of medical devices until 2018 (Figure 3 and Figure 4).

The Stagnation scenario (75% probability)

ü

Public budgets’ inability to keep financing new purchases will have its detrimental effect.

ü Competition between public facilities with paid services and private centers will increase, reducing expansion budgets in the private sector.

ü In the next 2-3 years consumption of medical devices will be made up mostly of expendables and maintenance, without significant appropriations of units.

ü Segments where private business has little presence will grow by 5-15% in 2015 (value) because of the need to compensate for the price spike, then stagnate.

ü Segments dominated by public buyers under the stagnation scenario will diminish by 3-5% because the mandatory health system lacks funds to both compensate the increase in drug costs and improve wages.

ü Weak budgets and the freezing of public spending on health care mean that only a portion of demand for new equipment will be satisfied. Consumption will return to 2009-2010 levels and suffer from limited budget allocation.

ü Most of the market growth will be inflationary, a reflection of new pricing and the ruble’s low exchange rate, and at any rate restricted by budget cuts.

ü The market’s resurgence will occur after equipment bought en masse in 2011-2013 has run its 4-6 years service life – some time after 2017.

ü Under this scenario CAGR in 2015-2018 is 0%.

The Improvement scenario (25% probability)

ü

The need to carry out the Health Care System Development program will prevail, resulting in more frequent surgical interventions and an expansion of the infrastructure.

ü Creation and outfitting of new medical centers, including for nuclear medicine and neonatology, will help the market.

ü Budgets in 2015 will suffer no further cuts and funding will remain at the level of the Development program.

ü The expansion of paid services in public clinics will compensate for reduced budgets and allow more devices and expendables to be acquired.

ü CAGR in 2015-2018 under this scenario is 2-5%.

Figure 4 reflects the increased foreign exchange volatility of the Russian ruble.

As it was mentioned above, the Stagnation scenario is more likely to happen. Under the Stagnation scenario we expect market consolidation. Most market players, both manufacturers and distributors, have expected stable growth of consumption and increasing government spending on health care in the last few years. The medical device market’s growth until 2013 was 1.5 times faster than GDP growth and several times faster than inflation.

In a period of stagnation some companies will not be able to compete, cut costs in time and overcome turnaround shortages.

This should give a certain edge to the largest equipment manufacturers who can attract outside financing or have sufficient reserves.

Among manufacturers and distributors diversified companies with a broad selection of products will be best-placed in the near future.

At the same time, under the Stagnation scenario the ruble's gradual decline vis-à-vis foreign currencies should give domestic producers opportunities to sell. This might maximize the effects of the government’s efforts to support home companies.